Another Month, Another Record High

This year will go down in the history books as one of the best for investors. It already has in many respects, as we outlined two months ago. And it just keeps going.

September and October are well-known as being the most challenging for traders, as stocks have tended to see their worst returns and highest volatility. In a premium post yesterday, Jay showed that over the past 120 years, if an investor held the Dow Industrials only during September and October, their return would have been -74% (though it hasn't been nearly as bad since 2008).

It's relatively unusual for the S&P 500 to close at a record high in August. It would be even more unusual if it did it in September.

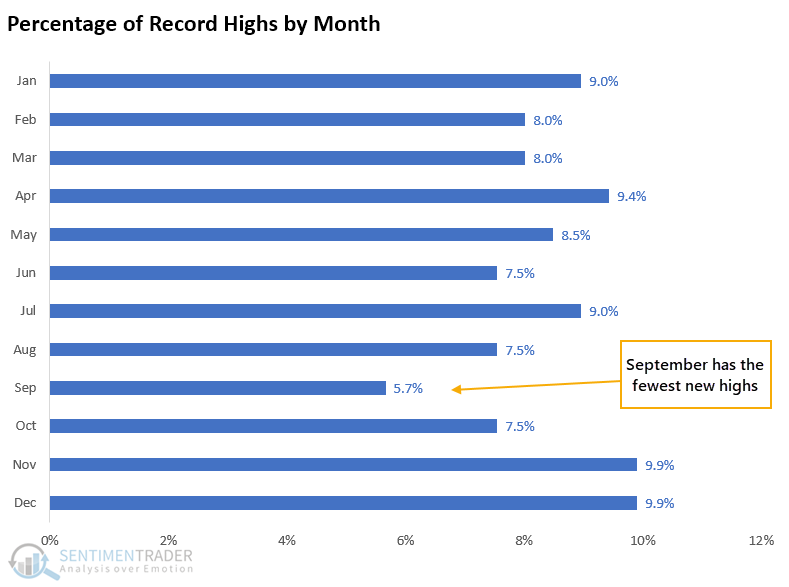

Since 1928, there have been 1,124 months, of which 212 closed at a record high. Out of those, only 12 occurred in September.

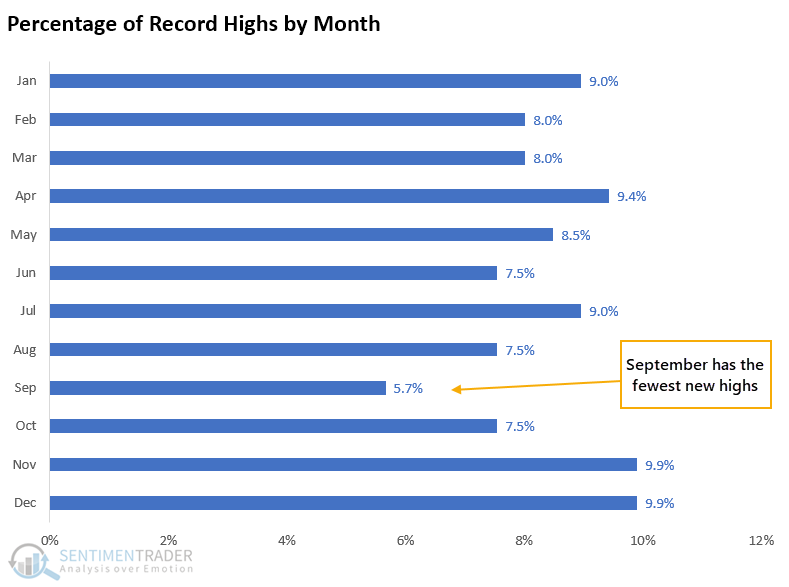

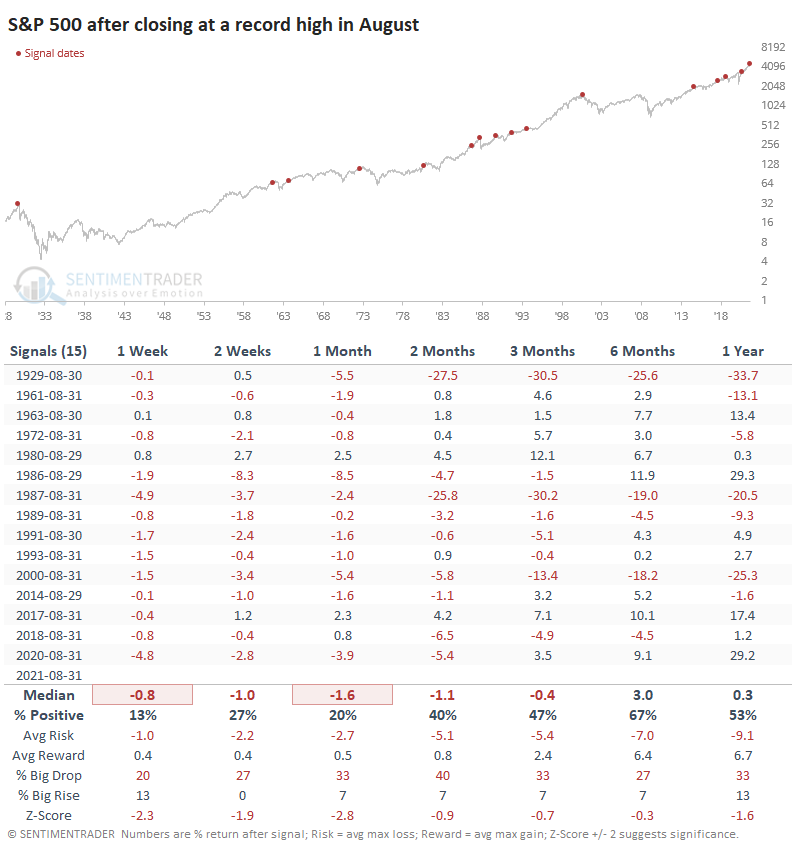

A SHORT-TERM WARNING

Stocks have rolled right over every possible negative in 2021, and seasonality is a tertiary factor anyway. So maybe we need to take the following table with a big grain of salt. It shows returns in the S&P 500 after it closes the month of August at an all-time high, and it's a sea of red.

Even though by definition, momentum was strong, the S&P had an incredibly hard time holding onto its gains over the next month. Most remarkably, the Risk/Reward Table shows that only two signals saw more reward than risk during the next month.

THE S&P WAS THE WORST

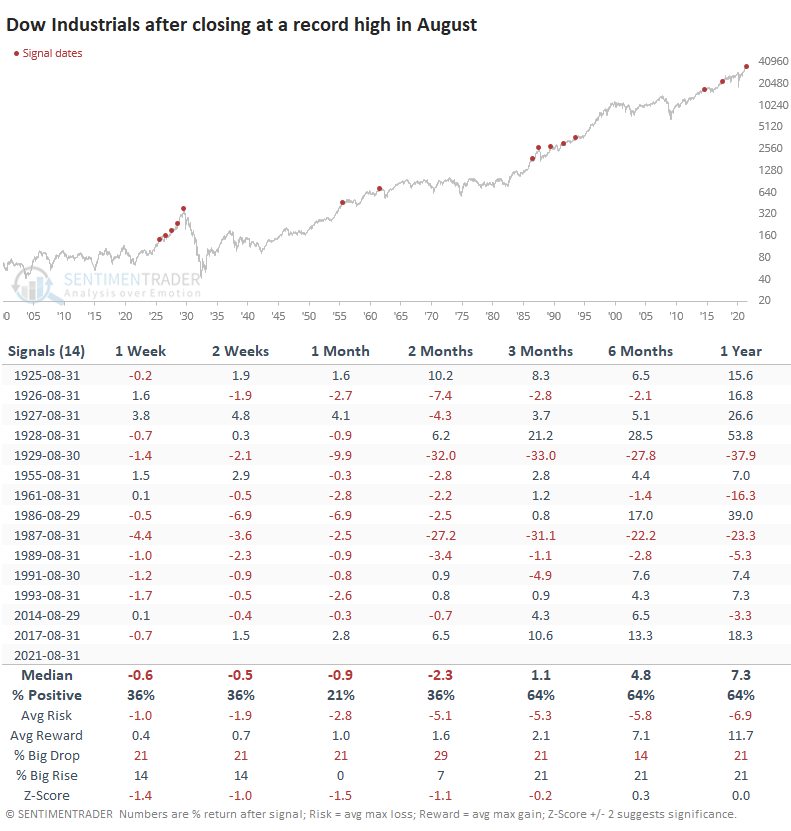

Looking at the other major indexes, the Dow Industrials also closed August at an all-time high. It, too, had a strong tendency to see some backing-and-filling over the next month or so, with an extremely poor risk/reward ratio up to two months later.

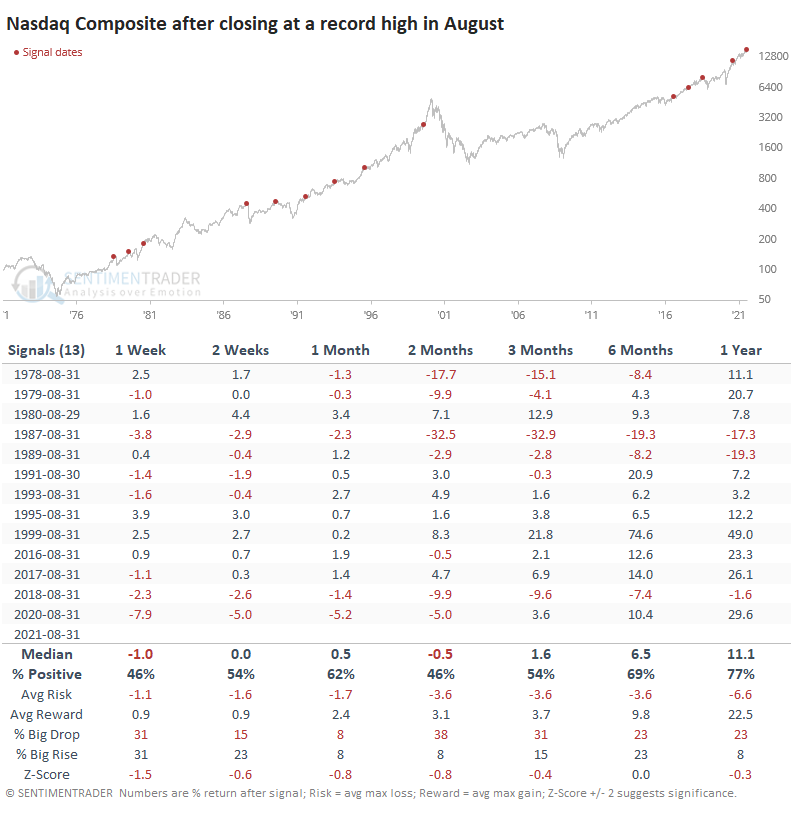

The Nasdaq Composite often does its own thing, and we can see from the table below that it had less of a tendency to see weakness after a new high in August. The last two signals saw a wicked pullback for traders, for what that's worth.

This has been a historic year for momentum in stocks, and when it is high-quality, momentum usually rolls over every other factor until it stops for whatever random reason. There is zero evidence that's going to be the case any time soon. Breadth has been questionable, which puts a dent in the "high-quality momentum" argument, but then there was an incredibly impressive thrust last week, so maybe that's moot. Buyers have been able to make doubters look like fools in 2021, and based on September's tendency, they have their work cut out for them again.