Financial conditions have made a strong recovery

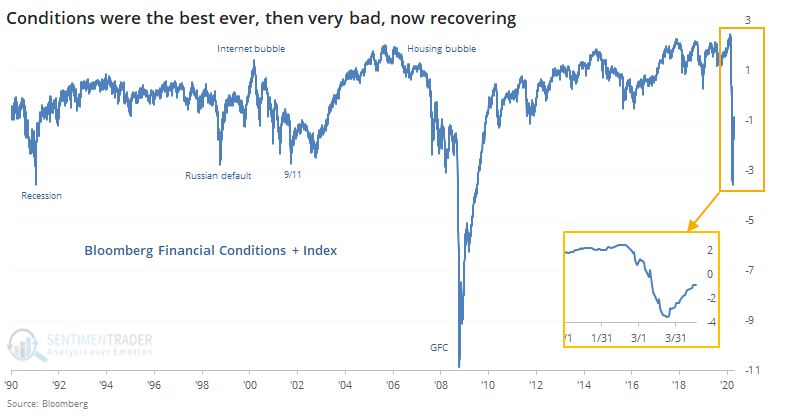

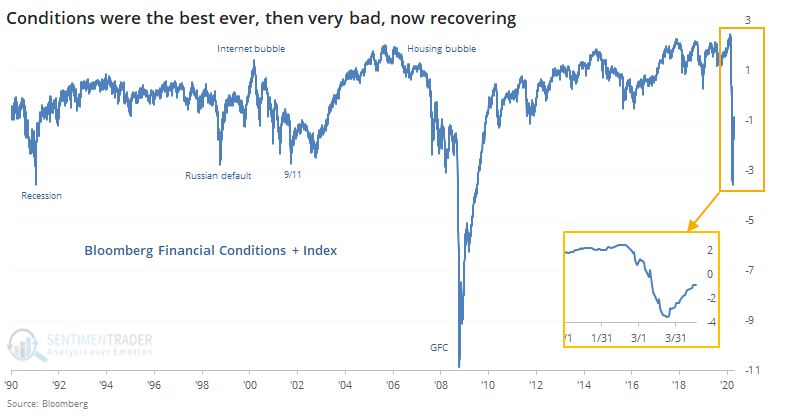

In mid-February, financial conditions were as good as it gets. The best in 30 years, at least.

March changed that in a hurry. Conditions when from the best-ever to one of the worst-ever in a matter of weeks. The Bloomberg Financial Conditions + index (BFC+) went from +2 to -2 in only three weeks, a record drop.

Per Bloomberg:

The Bloomberg Financial Conditions index tracks the overall level of financial stress in the U.S. money, bond, and equity markets to help assess the availability and cost of credit. A positive value indicates accommodative financial conditions, while a negative value indicates tighter financial conditions relative to pre-crisis norms. Bloomberg also calculates a Financial Conditions + index which includes all the elements of the BFCI index as well as indicators of asset-price bubbles, which also have an effect on financial conditions. These include tech-share prices, the housing market, and deviations from equilibrium yield levels.”

The rally off the March low has eased those conditions, however, and the index has reversed much of the decline.

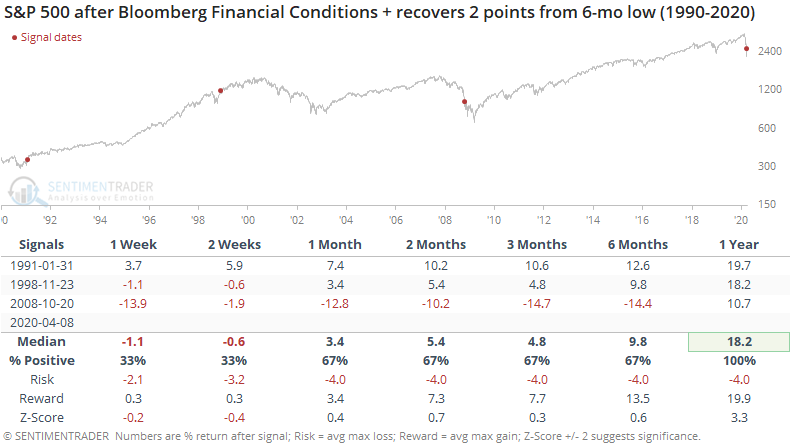

Below, we can see what happened the other times when the BFC+ recovered two points from a six-month low.

The first two were excellent signals that the recovery was in force and sustainable, with excellent gains and very little risk in the months ahead. Like so many other indicators have shown, the first post-panic moves in October-November 2008 were a head-fake and it preceded some painful months for those who bought into the initial recovery.

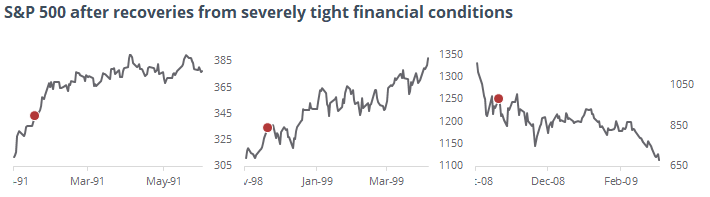

About the best determinant of which path the market was taking is price itself.

The first didn't see too much of a pullback, while the latter soon led to a lower low. Like with saw after other price and breadth surges, if March was truly an important turning point in the recovery, then we shouldn't see too much of this initial rally given back in the weeks ahead.