Gold's analogs and its tight correlation with tech stocks

On Monday, we saw that there have been a dozen or so time periods that have been highly correlated to the past 100 days in stocks. Despite what seems like an unprecedented move in other markets like gold, that market, too, has seen other stretches that look similar.

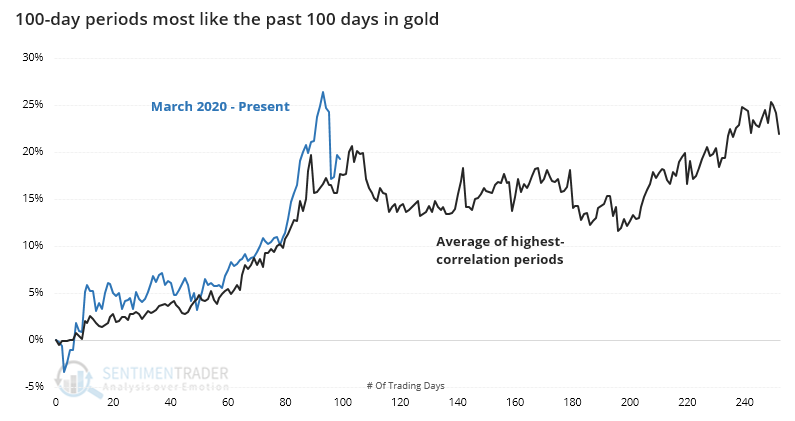

Just as we did with the S&P 500, we can go back to 1975 and look for the 100-day periods in gold that have the highest correlation to the past 100 sessions. When we do that, we get about a dozen stretches that have an extremely tight positive correlation to gold's path since March.

When we average them together, it looks like the following.

We can see just how tightly they tracked what we've seen so far in 2020. For what it's worth, the average peaked within the next couple of weeks.

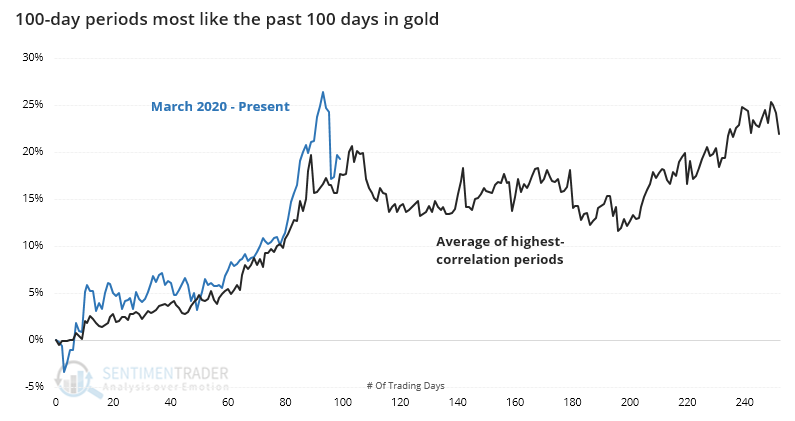

Below are the most recent occurrences (the dates are from the start of the 100-day analogs).

Not sure what it is about gold, but these 100-day stretches were about the longest it could go before correcting. Once the 100 days passed, gold did not perform well.

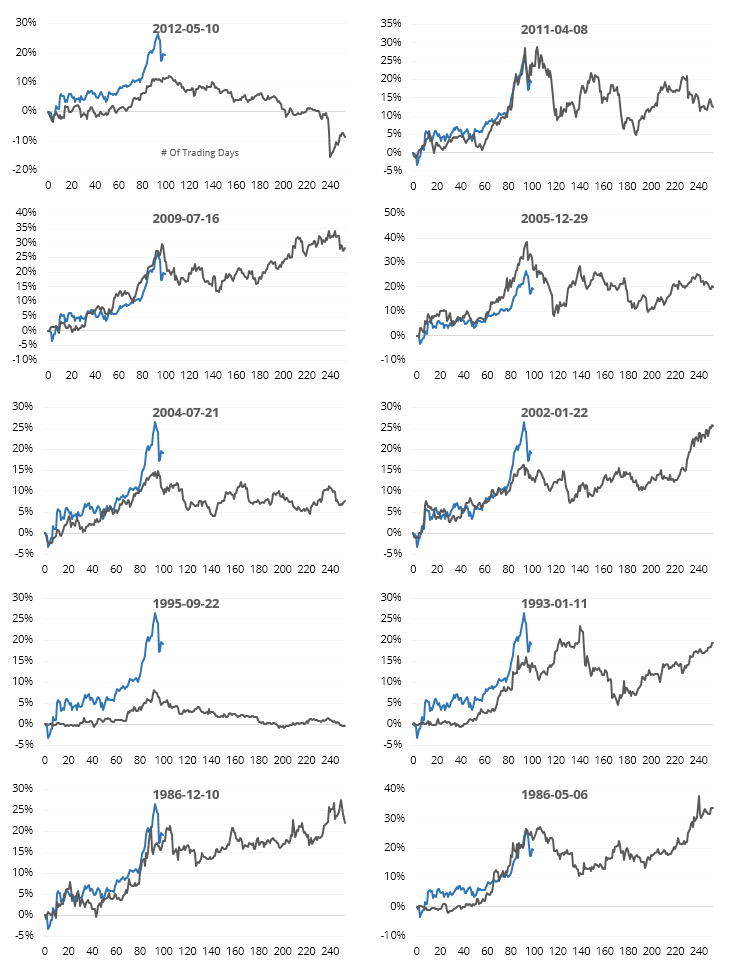

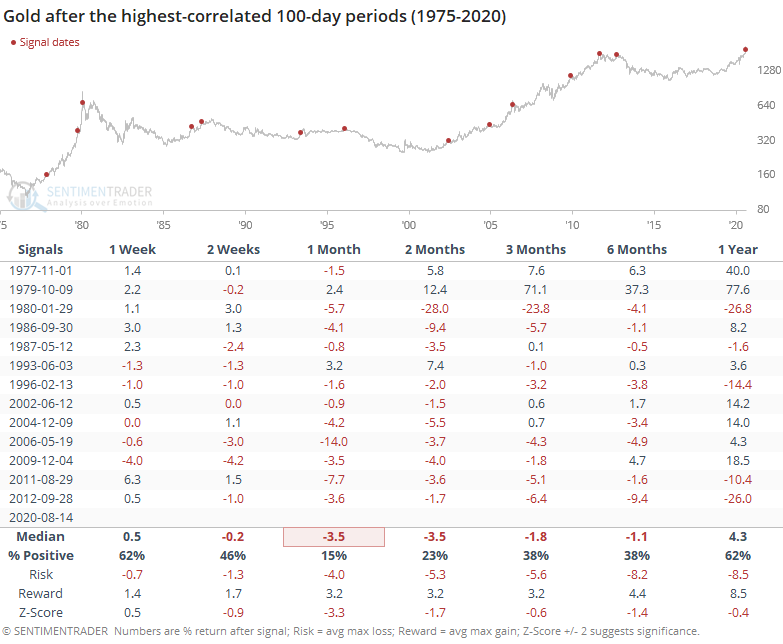

The next 1-6 months were wicked for the metal, with poor returns, poor consistency, and even worse risk/reward skew.

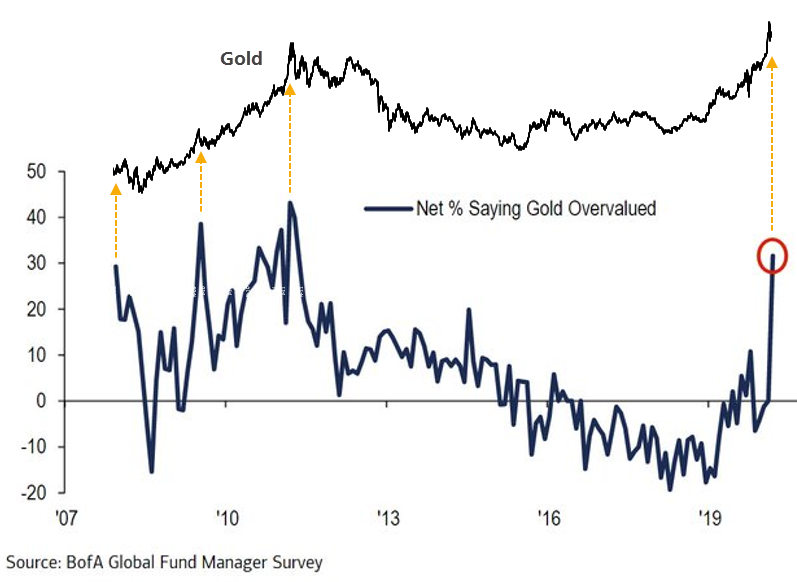

As the metal has perked up, some large institutional investors have become concerned that it's overvalued, as much as one can actually value a precious metal. The latest Bank of America Merrill Lynch survey of large fund managers shows that more than 30% of them think the metal has gone too far. While these managers have a mixed track record in other assets, their estimates of gold's value has been pretty good, which should be a worry here.

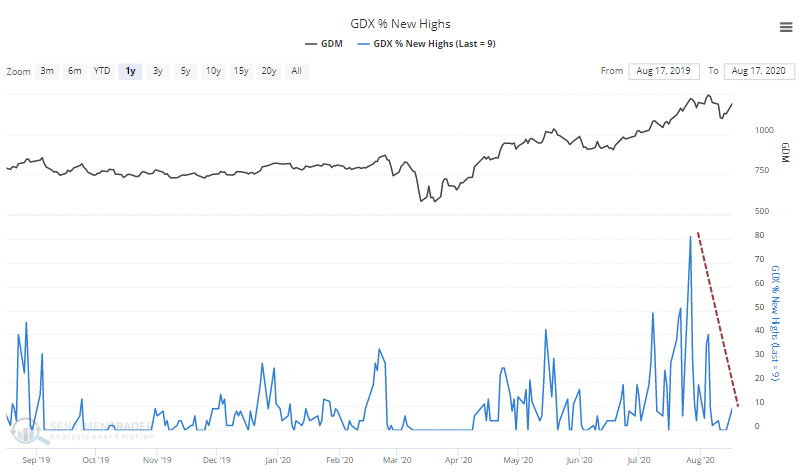

An interesting thing to watch among miners, given Berkshire's stake that was announced on Friday, is the broader reactions among them. While a few of them took off to the upside on Monday, there were significantly fewer of the stocks hitting new highs.

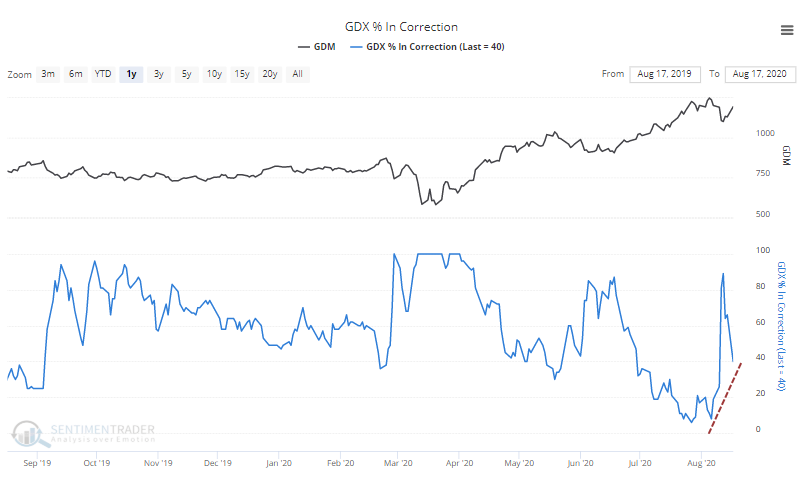

And more than 40% are still in a correction.

It's way too early to suggest that this is a negative divergence between GDX and its component stocks. It certainly bears watching in the days ahead if strength in only a few stocks like Barrick manage to mask some underlying weakness.

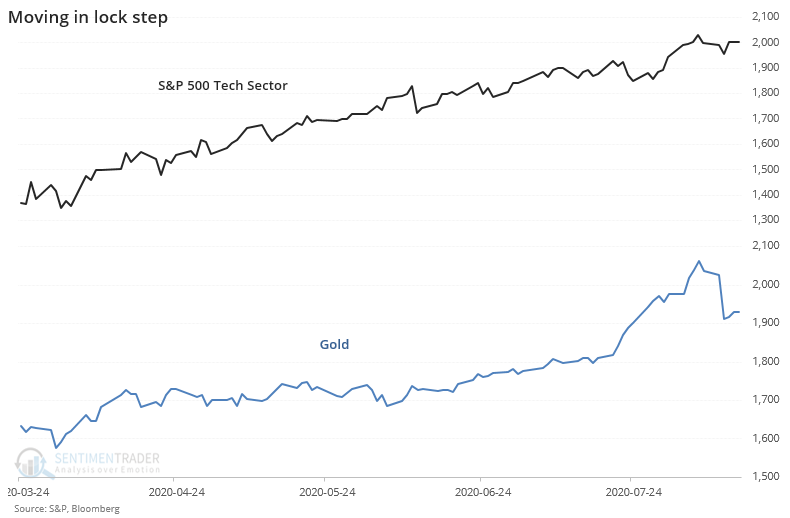

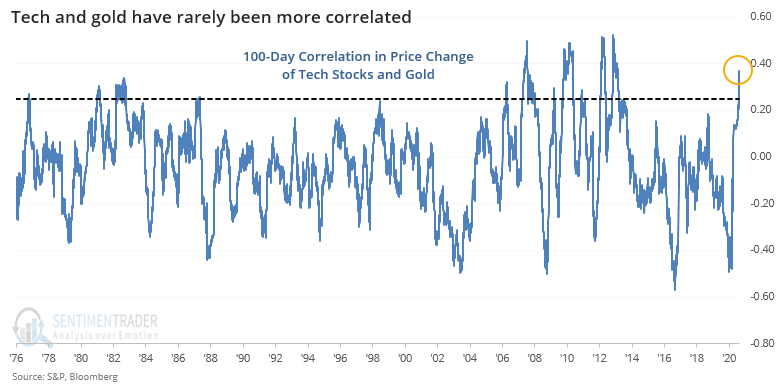

Along with gold, tech stocks have gone pretty much straight up since March.

The 100-day correlation between their daily percentage changes has skyrocketed to among the highest levels in history.

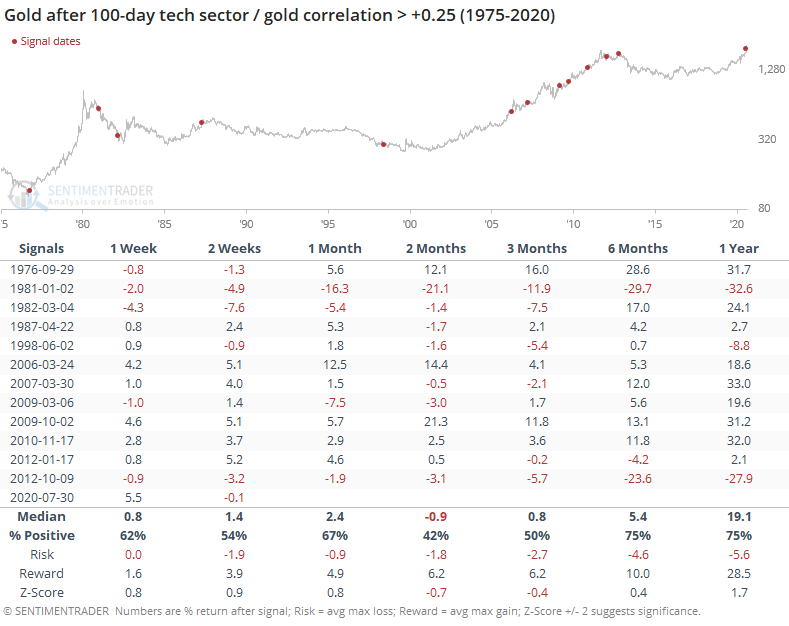

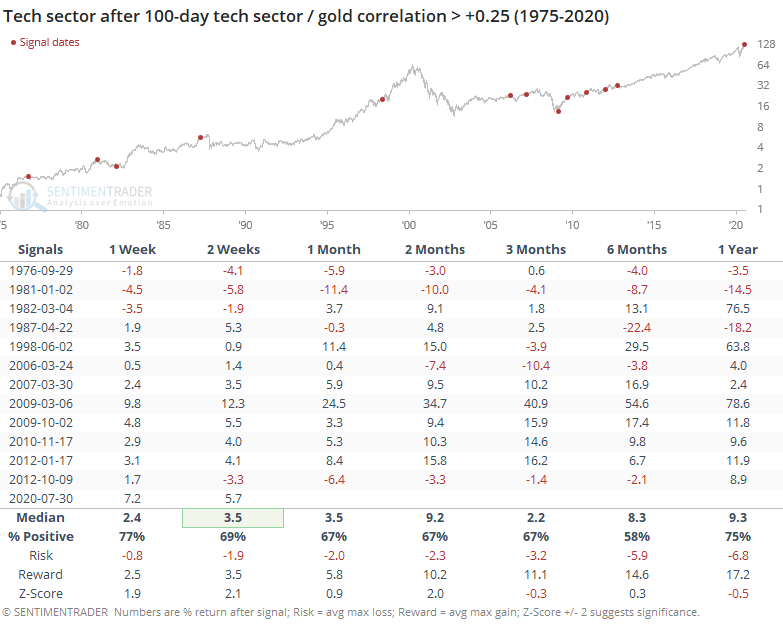

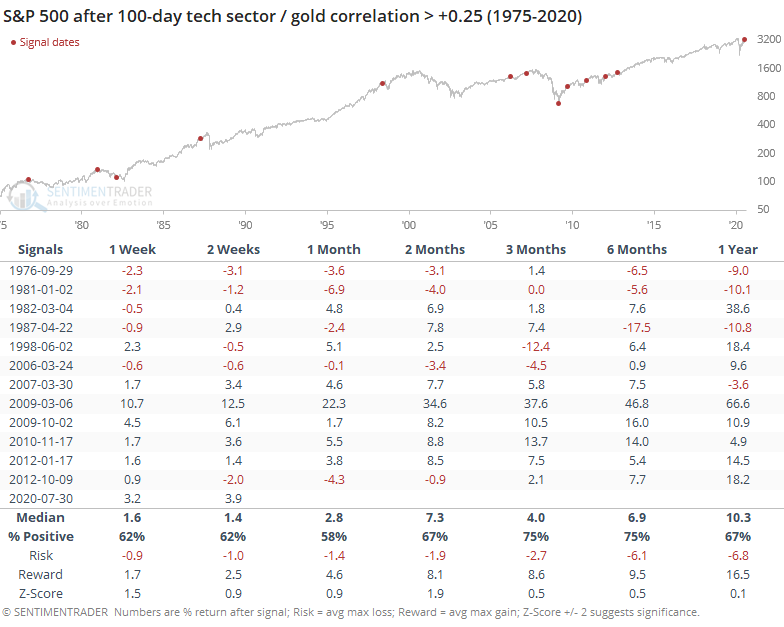

To see if it has meant anything consistent, the tables below show every time when their correlation exceeded +0.25 for the first time in about six months.

This was not a great sign for gold but was not a big edge. It tended to fall back over the next couple of months, with below-average returns. Thanks to many of the signals triggering during the 2000s bull market, the risk/reward was positive, so at least there's that.

Tech stocks mostly shrugged it off. There was no real edge there.

For the broader market, it was a mixed sign as well. The S&P 500's forward returns were about in line with random, with a couple of really bad returns and a few really good ones. There was no consistency.

It's tempting to assign a narrative to the big runup in tech stocks and gold, with the Fed's policies that favorite scapegoat. It's probably true. But the two assets have traveled together before, even tighter than they are now, and it didn't mean anything consistent going forward.

More damning for gold is the fact that other times it enjoyed 100-day stretches like its current one, it almost invariably fell back in the month(s) ahead. We don't place a lot of weight on analogs though it does support the idea of a headwind when coupled with such high optimism as it's been seeing.