Investors keep shifting money from stocks to bonds

There are enough signs of optimism and speculative activity that Dumb Money Confidence is tickling one of its highest levels in 20 years.

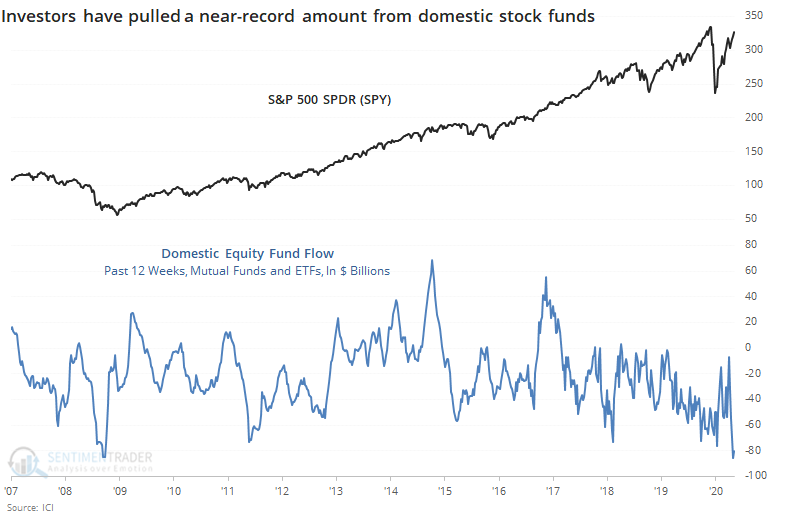

That doesn't mean everything agrees, as we saw on Wednesday. As noted, another outlier among indicators is fund flows, which have been suppressed for months on end.

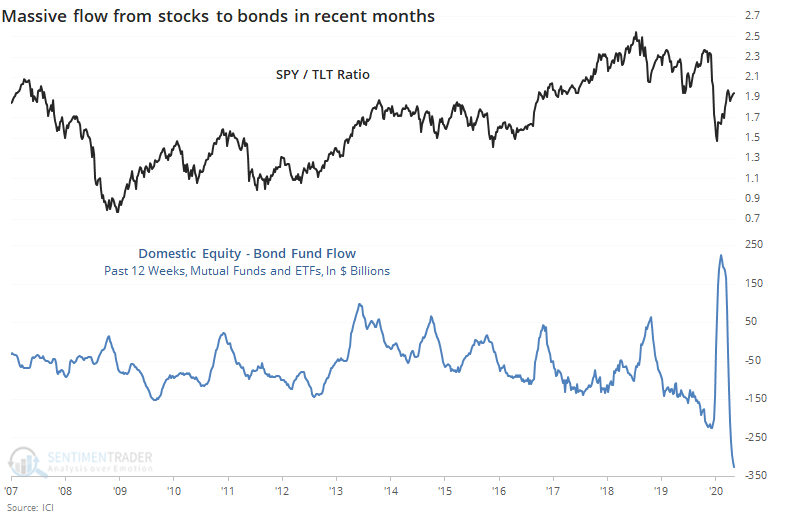

Over the past 12 weeks, investors have yanked more than $80 billion from domestic equity mutual funds and ETFs, a bout of pessimism that was only (barely) eclipsed in 2008.

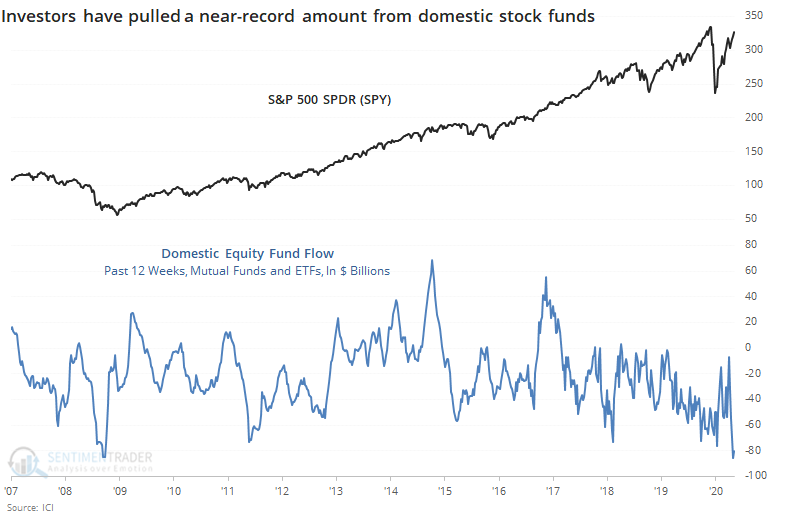

Among overseas funds, the outflow has never been greater over such a compressed time frame. Fund flows have worked as a contrary indicator with these stocks better than other assets or geographies, as we discussed in May. It's curious that despite the gains in these stocks, outflows have been even more consistent than in domestic funds.

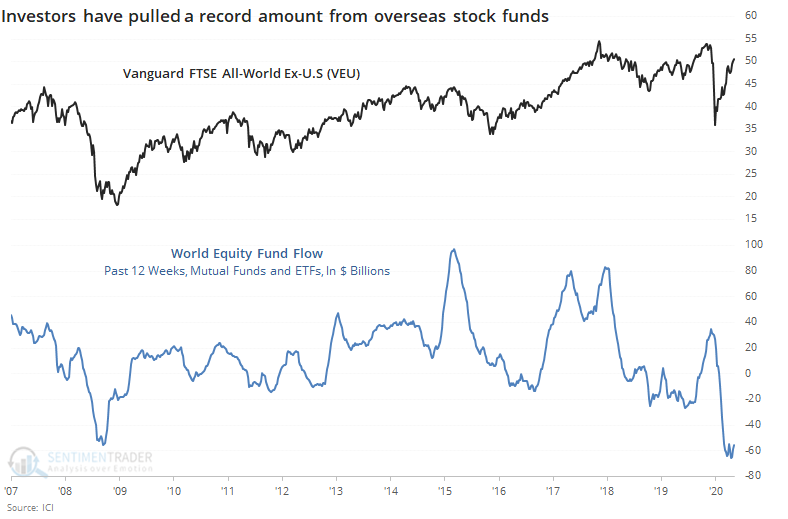

Where did all the money go? Bonds, partially. They've sucked in nearly $250 billion in assets in just three months. That has erased the pandemic-fueled outflow.

Typically, a rush of funds out of stocks and into bonds would be a reliable contrary indicator, suggesting stocks should outperform bonds going forward. It pretty much was, until the last year.

Fund flows have become very wonky since 2019, for unclear reasons. They've mostly decoupled from historical behavior, and that makes it harder to rely on them as a measure of sentiment. As much as we can rely on them, flows would suggest a modest positive for stocks (especially overseas) and negative for bonds in the months ahead.