Nasdaq Joins the Breadth Thrust Party

Stocks traded on the NYSE decided to make a fool out of those worried about weak breadth. Last week, the Nasdaq joined the party.

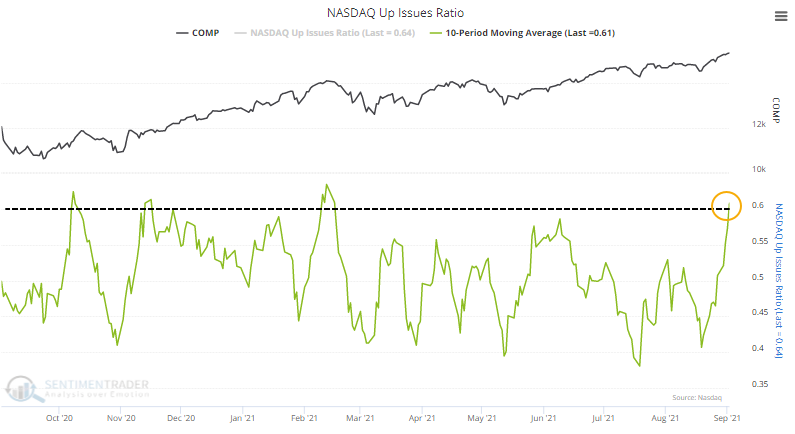

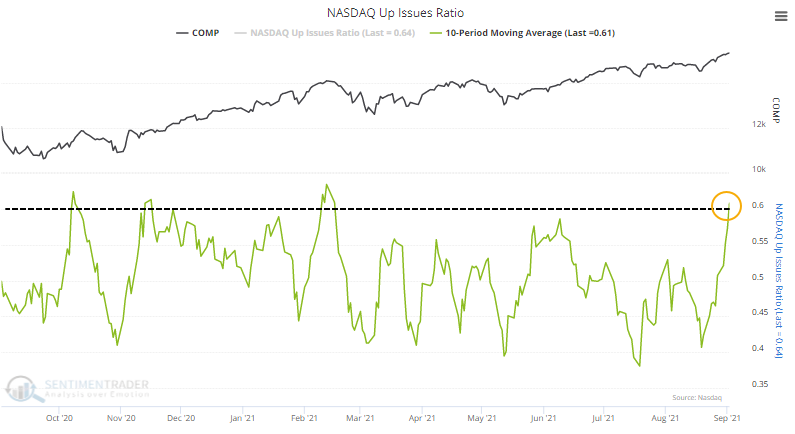

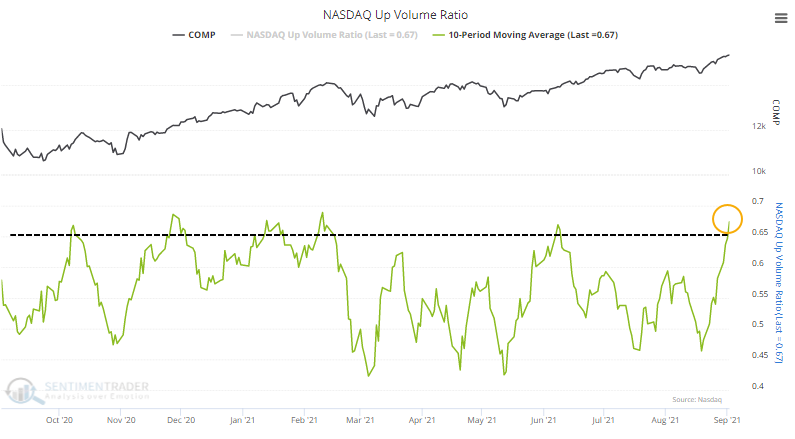

After weeks of disturbingly poor internal participation and a flurry of technical warning signs, stocks on the Nasdaq thrust higher last week. In a premium note, Dean showed a reversal signal in the Nasdaq McClellan Oscillator. We can see something similar in its component indicators, the Up Issues Ratio and Up Volume Ratio.

Over the past 10 days, an average of more than 60% of securities on the Nasdaq advanced.

Even more impressively, more than 65% of volume flowed into advancing issues on average each day. Granted, volume at the end of August tends to be tepid, but it was still focused on the winners.

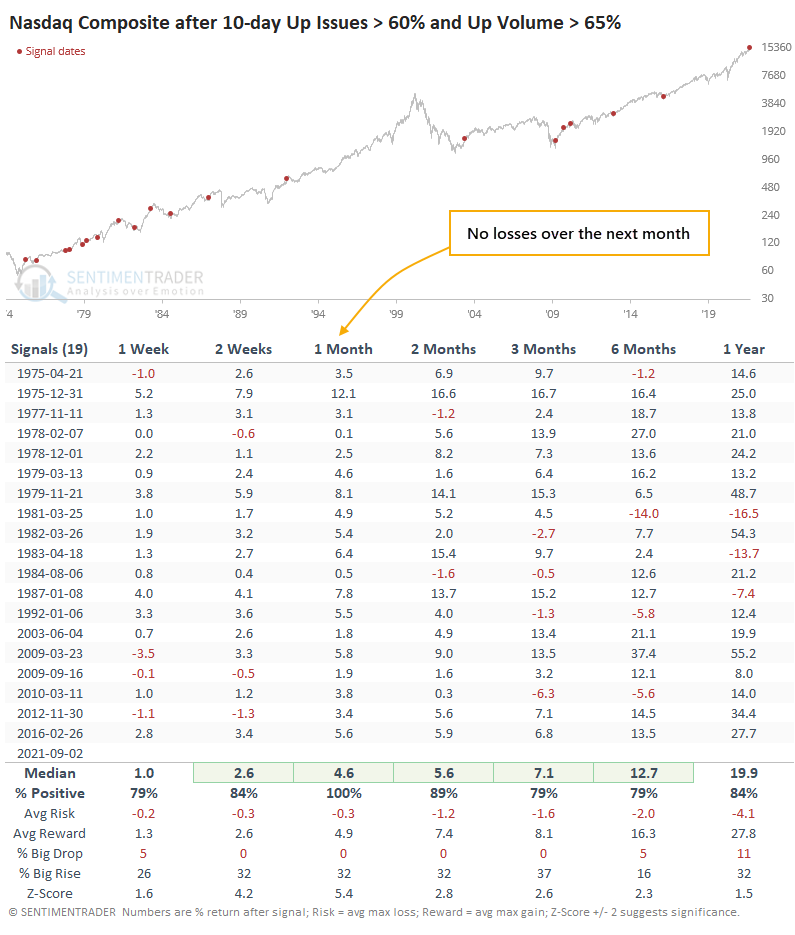

A SIGNAL WITH NO LOSSES

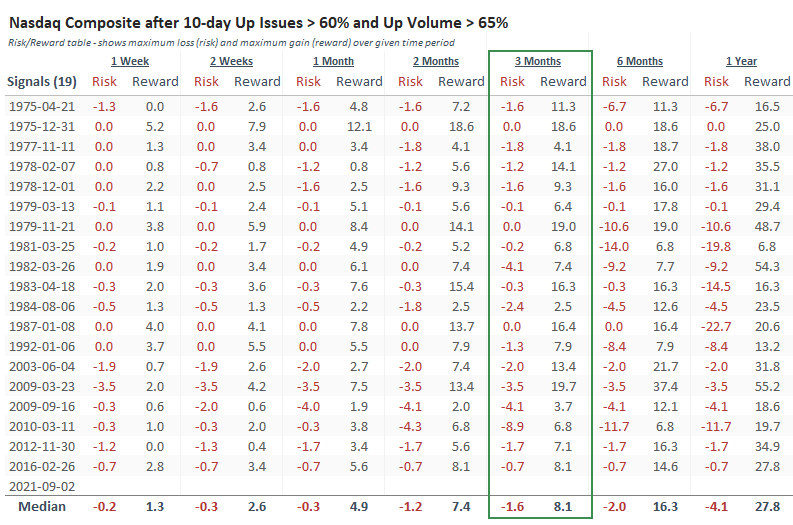

Thrusts like this have been exceptionally positive for forward returns.

As we so often see after thrusts like this, the most notable aspect was the ridiculously skewed risk/reward ratio. Over the next three months, only one signal showed a loss at its worst point of more than -4.1%, while sixteen of them showed a gain at their best point of more than +4.1%.

Here's the rub, though...

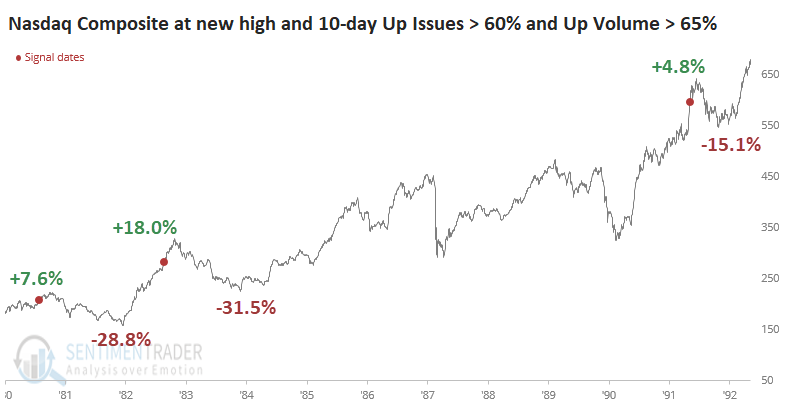

Oddly, the thrust triggered when the Composite was trading at a new high. Most of them came after protracted declines. Out of all the signals, only three others triggered with the Composite at (or even near) a multi-year high (1981-03-25, 1983-04-18, and 1992-01-06). The chart below shows how the Nasdaq rallied in the shorter term each time...and each of them was also a blow-off peak.

This is one more sign that the concerns from earlier this spring and summer, which never really had much impact (on the major indexes, anyway), are falling by the wayside. The internal thrusts in recent weeks have been impressive and carry a compelling historical record of more gains ahead.

The biggest concern, and it is a concern, is that these are occurring when the indexes are trading at record highs and valuations, which increases the probability that we're in the process of a blow-off peak.