Waiting for the Fat Pitch

The broad market is in an environment known as "No Man's Land." That means we have a few oversold short-term indicators with several intermediate to long-term indicators that are deteriorating but above a level that creates a fat pitch situation.

Remember the following:

"The markets do whatever they have to do to frustrate the most people."

So, that means we may never get the fat pitch oversold situation we seek to allocate fresh capital.

However, even if we don't get a noteworthy oversold condition in the broad market, the following models could trigger a reversal signal.

As always, a weight-of-the-evidence approach is always preferable to one that relies upon a single indicator or model.

VIX FUTURES RANGE RANK REVERSAL BUY SIGNAL

The VIX Futures Range Rank signal seeks to identify instances in history when the 4-month range rank for the VIX Futures Continuous Contract #6 reverses from a period of high volatility to low volatility.

Click here for the original note and concept details.

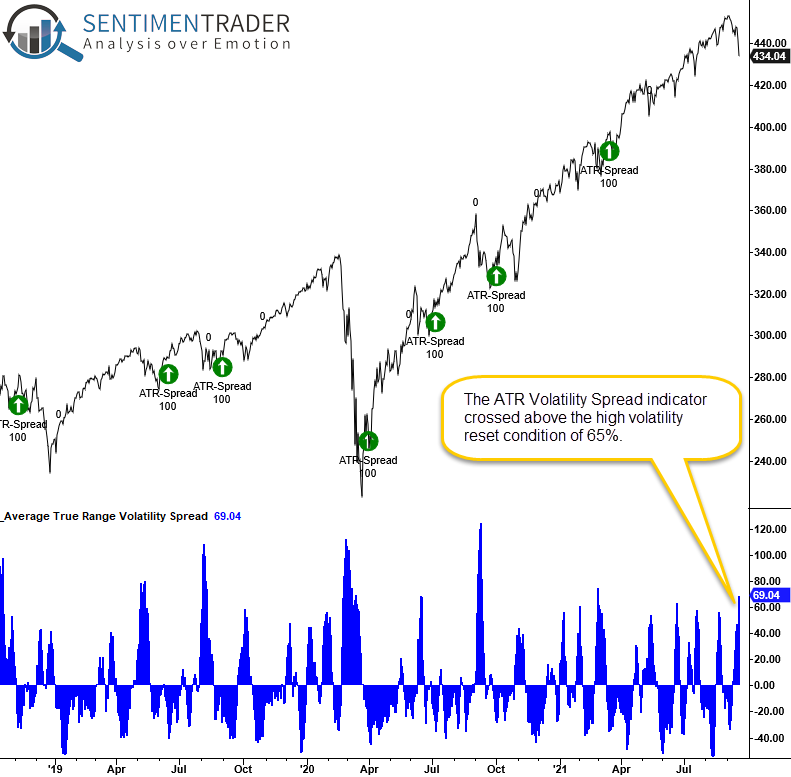

AVERAGE TRUE RANGE VOLATILITY REVERSAL BUY SIGNAL

The average true range spread signal identifies when a stock, ETF, or commodity reverses from a period of high volatility to low volatility in a user-defined number of days.

Click here for the original note and concept details.

S&P 500 ETF (SPY)

NASDAQ 100 ETF (QQQ)

COMPOSITE BREADTH INDICATOR BUY SIGNAL

The composite breadth signal identifies when the N-day net change in the composite breadth indicator surges above a user-defined threshold level.

Click here for the original note and concept details.

PERCENT OF MEMBERS ABOVE THE 10-DAY AVERAGE BUY SIGNAL

The percentage of members above the 10-day average seeks to identify instances in history when the number of members trading above their respective 10-day moving average cycles from oversold to overbought in a user-defined number of days or less.

Click here for the original note and concept details.